Audit procedures types auditor

Table of Contents

Table of Contents

Are you wondering how to calculate drawing power in stock audit? Drawing power is a critical component of a stock audit, but many people find it confusing or difficult to understand. In this article, we’ll explain how to calculate drawing power in stock audit in plain language so you can better understand this important metric.

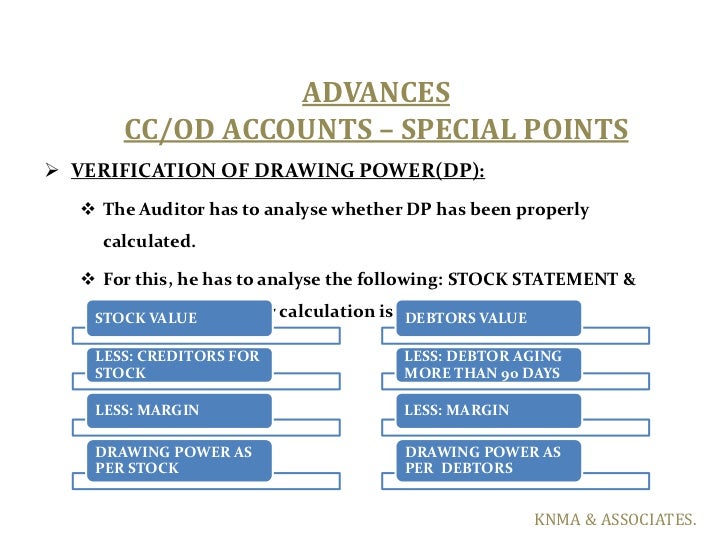

As you may already know, a stock audit is an examination of a company’s inventory. The goal of a stock audit is to determine the accuracy of a company’s recorded inventory levels and identify discrepancies that could impact the accuracy of financial reports. Drawing power is a metric used in stock audits to determine the amount of financing a company is eligible for based on the value of their inventory.

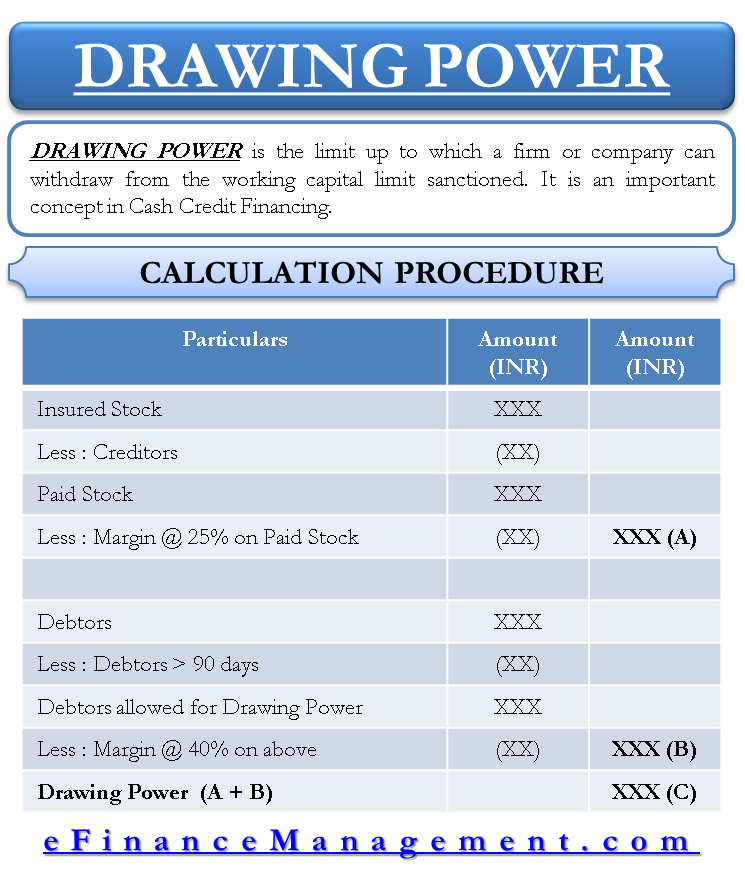

So, how is drawing power calculated in a stock audit? Drawing power is calculated as a percentage of the net realizable value of a company’s inventory. Net realizable value is the estimated selling price of inventory minus the cost of selling it. The percentage of net realizable value that a company is eligible to finance depends on the lender’s policies, but generally ranges from 50-80%.

In summary, drawing power is a metric used in stock audits to determine the amount of financing a company is eligible for based on the value of their inventory. Drawing power is calculated as a percentage of the net realizable value of a company’s inventory. The percentage of net realizable value that a company is eligible to finance depends on the lender’s policies.

How to Calculate Drawing Power in Stock Audit

One of the most straightforward ways to calculate drawing power in stock audit is to use a formula. Start by calculating the net realizable value of your inventory, which is the estimated selling price of your inventory minus the cost of selling it. Next, multiply the net realizable value by the lender’s percentage to determine the maximum amount of financing you’re eligible for.

For example, if the net realizable value of your inventory is $100,000 and the lender’s percentage is 70%, your drawing power would be $70,000. This means you’re eligible to finance up to $70,000 based on the value of your inventory.

Common Mistakes When Calculating Drawing Power in Stock Audit

One of the most common mistakes people make when calculating drawing power in stock audit is forgetting to calculate the net realizable value of their inventory. Another mistake is using the wrong percentage when determining the amount of financing they’re eligible for. It’s important to carefully review lender policies and use the correct percentage when calculating drawing power.

Factors That Impact Drawing Power in Stock Audit

Several factors can impact drawing power in a stock audit, including the accuracy of inventory records, the age and condition of inventory, and the level of demand for a company’s products. It’s important to regularly review and update inventory records to ensure their accuracy, as errors can negatively impact drawing power.

Additional Considerations When Calculating Drawing Power in Stock Audit

It’s important to remember that drawing power is just one metric used in stock audits, and companies may be subject to additional eligibility requirements and restrictions. It’s always a good idea to consult with a financial professional when calculating drawing power and evaluating financing options.

Frequently Asked Questions about How to Calculate Drawing Power in Stock Audit

Q: What is drawing power in stock audit?

A: Drawing power is a metric used in stock audits to determine the amount of financing a company is eligible for based on the value of their inventory.

Q: How is drawing power calculated in stock audit?

A: Drawing power is calculated as a percentage of the net realizable value of a company’s inventory.

Q: What is net realizable value in stock audit?

A: Net realizable value is the estimated selling price of inventory minus the cost of selling it.

Q: What factors can impact drawing power in stock audit?

A: Several factors can impact drawing power in stock audit, including the accuracy of inventory records, the age and condition of inventory, and the level of demand for a company’s products.

Conclusion of How to Calculate Drawing Power in Stock Audit

Understanding how to calculate drawing power in stock audit is crucial for companies looking to secure financing based on the value of their inventory. By calculating drawing power correctly and accounting for relevant factors, companies can ensure they’re maximizing their eligible financing options. Remember to consult with a financial professional and carefully review lender policies when evaluating financing options.

Gallery

Stock Audit Procedures And Types | Stock Auditor | VGNC

Photo Credit by: bing.com / audit procedures types auditor

Calculate Stock Image. Image Of Architect, Drawing, Tarpaulins - 13610895

Photo Credit by: bing.com / calculate preview

Royalty Free Calculator Clipart Clip Art, Vector Images & Illustrations

Photo Credit by: bing.com / calculatrice vector taschenrechner kalkulator vecteur einzelner vettore schizzo singolo calcolatore pojedynczego szkicu croquis depositphotos kalkulatora nikiteev

How Drawing Power Is Calculated - Flow Chart

Photo Credit by: bing.com / audit concurrent

Drawing Power

Photo Credit by: bing.com / power drawing calculation bank if