Retirement money saving savings planning wealth taxes istock enough putting mistake until why off big percent americans washingtonpost

Table of Contents

Table of Contents

Are you close to retirement or already retired and wondering how best to draw income from your retirement savings? Do you worry about running out of money later in life? You’re not alone. Many people struggle with this question and want to ensure they make the most of their hard-earned savings. In this article, we’ll explore the best practices for drawing income from your retirement savings.

Common Concerns

As you approach retirement, there are a few common concerns that come to mind. You may be worried about outliving your money, market volatility, and navigating tax implications. Additionally, social security, healthcare costs, and inflation can create uncertainty around your retirement income. All these issues can make deciding how best to draw income from your savings a difficult task.

Best Practices

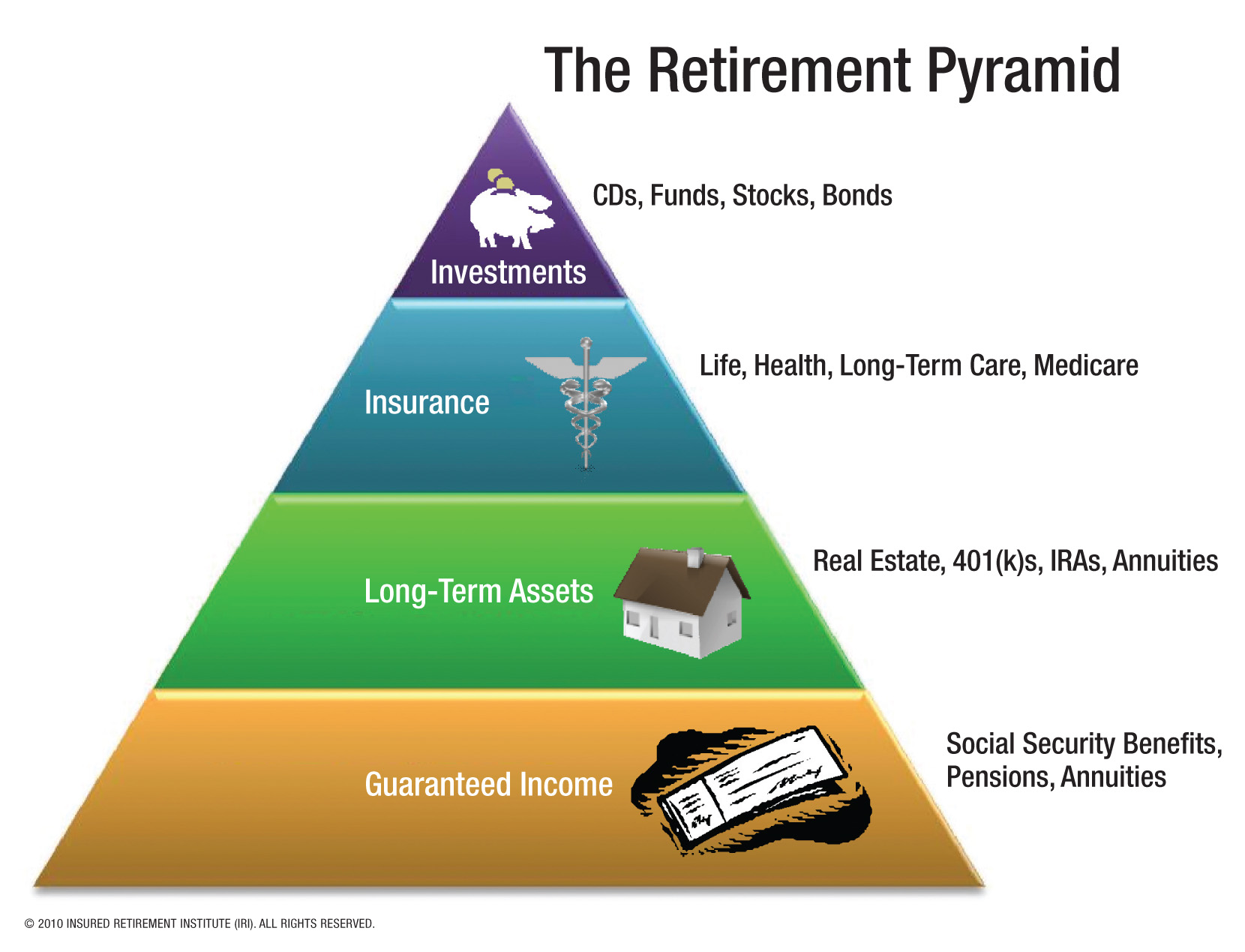

The key to drawing income from your retirement savings is to develop a plan. A solid plan will ensure you have the necessary funds to support your lifestyle in retirement. First, it’s essential to have a diverse portfolio that can withstand market fluctuations. We recommend a mix of stocks, bonds, and cash investments based on your individual risk tolerance and goals.

Next, consider your withdrawal strategy. One approach is to follow the “4% rule,” which suggests withdrawing 4% of your portfolio’s value in the first year of retirement, adjusted for inflation in subsequent years. Another popular option is to use a cash reserve strategy, where you withdraw money from a cash reserve account, replenished annually.

Next, consider your withdrawal strategy. One approach is to follow the “4% rule,” which suggests withdrawing 4% of your portfolio’s value in the first year of retirement, adjusted for inflation in subsequent years. Another popular option is to use a cash reserve strategy, where you withdraw money from a cash reserve account, replenished annually.

Summary of Best Practices

Developing a comprehensive plan that includes diversification, a solid withdrawal strategy, and consideration for tax implications, healthcare costs, and social security is essential for drawing income from your retirement savings. These practices will provide peace of mind and ensure your savings last throughout your retirement years.

Choosing Your Withdrawal Strategy

The 4% rule is a common approach but may not work for everyone. One advantage is that it provides a reliable income stream, but the downside is you’ve limited flexibility in tough markets. In contrast, a cash reserve strategy has more flexibility but may require a more significant initial investment. Regardless of the method, it’s crucial to review and adjust your plan regularly.

Tax Considerations

It’s essential to consider the tax implications of your withdrawal strategy. If you withdraw money from a traditional IRA or 401(k), you will pay income taxes on those funds. In contrast, Roth IRA withdrawals are typically tax-free, making them an attractive option. A financial advisor can help you understand how your withdrawal strategy impacts your tax situation.

Social Security

Deciding when to begin taking social security benefits is another critical consideration when planning your retirement income. Taking benefits early may reduce the overall payout, while waiting longer may result in more significant payments. We advise carefully weighing your options to determine what’s best for your individual circumstances.

Inflation and Healthcare Costs

It’s vital to consider the impact of inflation and healthcare costs on your retirement savings. Inflation means your money’s purchasing power will decrease over time, and healthcare costs tend to increase as you age. One solution is to purchase an annuity that provides a guaranteed income stream over time, helping to offset these costs.

Question and Answer

Q: How much of my savings should I withdraw each year?

A: The answer varies based on individual circumstances. We recommend following a withdrawal strategy that aligns with your risk tolerance and goals.

Q: What is the 4% rule?

A: The 4% rule suggests withdrawing 4% of your portfolio’s value in the first year of retirement, adjusted for inflation in subsequent years.

Q: How can a financial advisor help with my retirement income plan?

A: A financial advisor can help you create a plan that considers your individual circumstances and goals while providing insight into tax implications and investment strategies.

Q: When should I begin taking social security benefits?

A: It’s essential to weigh your options carefully and consider your individual circumstances. Taking benefits early may reduce the overall payout, while waiting longer may result in more significant payments.

Conclusion of How Best to Draw Income From Your Retirement Savings

Drawing income from your retirement savings requires careful planning and consideration of individual circumstances. A diversified portfolio, solid withdrawal strategy, and attention to tax implications, inflation, and healthcare costs are all essential components. Working with a financial advisor can help ensure you make the most of your retirement savings and enjoy the lifestyle you desire in your golden years.

Gallery

Retirement Savings By Age - Contribution From Income | Public

Photo Credit by: bing.com / savings retirement public

Retirement Planning Can Save You Money On Taxes - Retirement News Online

Photo Credit by: bing.com / retirement money saving savings planning wealth taxes istock enough putting mistake until why off big percent americans washingtonpost

Three Steps To Generate More Income From Your Retirement Savings

Photo Credit by: bing.com / generate retirement income savings steps three

Drawing Down Retirement Savings In A Pandemic Retirement Savings

Photo Credit by: bing.com / retirement pandemic

Financial Retirement | Jonathan Li’s Blog

Photo Credit by: bing.com / pyramid